UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

oConfidential, for Use of the Commission | |

| Only (as permitted by Rule 14a-6(e)(2)) | |

x Definitive Proxy Statement | |

o Definitive Additional Materials | |

o Soliciting Material Pursuant to Sec.240.14a-12 |

| 99¢ Only Stores |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

99¢ ONLY STORES

NOTICE OF 2008 ANNUAL MEETING OF SHAREHOLDERS

| TIME AND DATE | 9:00 a.m. Pacific Time on | |

| PLACE | City of Commerce Community Center Rosewood Park Meeting Room 5600 Harbor Street City of Commerce, California 90040 | |

| ITEMS OF BUSINESS | (1) | To elect a Board of nine directors, each to hold office until the next annual meeting of shareholders and until his or her successor is elected. |

| (2) | To ratify the appointment of BDO Seidman, LLP as our independent registered public accounting firm for our fiscal year ending March 28, 2009. | |

| To consider and act upon a shareholder proposal, if properly presented at this meeting. | ||

| (4) | To transact such other business as may properly come before the annual meeting | |

| RECORD DATE | You can vote at the meeting and at any adjournment or postponement of the meeting if at the close of business on | |

| PROXY VOTING | All shareholders are cordially invited to attend the annual meeting in person. However, to ensure your representation at the annual meeting, you are urged to complete and return the enclosed proxy as promptly as possible. If you receive more than one proxy card because you own shares registered in different names or at different addresses, each card should be completed and returned. | |

| ANNUAL REPORT | Copies of our Annual Report on Form 10-K for the fiscal year ended March 29, 2008, including our audited financial statements, are being mailed to shareholders concurrently with this Proxy Statement. | |

| INTERNET AVAILABILITY OF MATERIALS | ||

| By order of the Board of Directors | |

| /s/ Eric Schiffer | |

| July 28, 2008 | Eric Schiffer |

Chief Executive Officer |

99¢ ONLY STORES

PROXY STATEMENT

FOR THE 20062008 ANNUAL MEETING OF SHAREHOLDERS ON

You are invited to attend the Company’sour annual meeting of shareholders on Friday, May 11, 2007,Monday, September 23, 2008, beginning at 9:10:00 a.m. Pacific Time. The meeting will be held at the City of Commerce Community Center, Rosewood Park Meeting Room, 5600 Harbor Street, City of Commerce, California 90040.

Shareholders Entitled to Vote. TheWe have set the close of business on March 12, 2007 has been fixedJuly 25, 2008 as the record date for the determination ofdetermining shareholders entitled to notice of and to vote at the annual meeting and any postponementspostponement or adjournmentsadjournment thereof. At the record date, 69,937,29770,060,491 shares of the Company’sour common stock, no par value, were outstanding. The Company’sOur common stock is the only outstanding class of securities entitled to vote at the annual meeting. At the record date, the Companywe had approximately 15,28212,336 shareholders, which includes 418396 shareholders of record.

Proxies. Your vote is important. If your shares are registered in your name, you are a shareholder of record. If your shares are in the name of your broker or bank,financial institution, your shares are held in street name. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting even if you cannot attend. Your submission of the enclosed proxy will not limit your right to vote at the annual meeting if you later decide to attend in person. If your shares are held in a street name, however, you must direct the holder of record as to how to vote your shares, or you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the meeting. If you are a record holder, you may revoke your proxy at any time before the meeting either by filing with the Company’sour Secretary, at the Company’sour principal executive offices, a written notice of revocation or a duly executed proxy bearing a later date, or by attending the annual meeting and voting your shares in person. If no instruction is specified on the enclosed proxy with respect to a matter to be acted upon, the shares represented by the proxy will be voted (i) in favor offor the election as directors of the nominees for director set forth herein, (ii) for the ratification of the appointment of BDO Seidman, LLP as our independent registered public accounting firm for our fiscal year ending March 28, 2009, (iii) against the shareholder proposal set forth herein, if properly presented, and (iii)(iv) if any other business is properly presented at the annual meeting, in accordance with the best judgment of the proxyholders.proxy holders.

Quorum. Under California law, where we are incorporated, shareholders may take action at our annual meeting by voting their shares of common stock as described above, provided a quorum is present. At least a majority of the outstanding shares of our common stock entitled to vote must be present or represented at our annual meeting to establish a quorum. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of establishing a quorum. Broker non-votes occur when a broker, financial institution or other holder of record does not receive instructions from a beneficial owner and does not have discretionary authority to vote on a particular item. Per current New York Stock Exchange rules, brokers have discretionary authority to vote on the election of directors and on the ratification of the appointment of our independent registered public accounting firm. Brokers do not, however, have discretionary authority to vote on the shareholder proposal in this Proxy Statement. Accordingly, broker non-votes will not be counted towardconsidered entitled to vote for this proposal and will have no effect on the tabulationoutcome.

Election of votes cast on proposals submittedDirectors. Per our Bylaws, each director nominee in an uncontested election must receive the affirmative vote of a majority of the shares of our common stock represented and voting to shareholders andbe elected to the Board of Directors. This election is an uncontested election. You may vote “for” all director nominees or you may vote “against” or “abstain” with respect to one or more director nominees. Shares of our common stock that are not present or represented at our annual meeting will not affect the outcome of the election of directors. Abstentions will have the same effect as negative votes, while broker non-votes will not be counted as votes cast against such matters.

.

If an incumbent director fails to win re-election to the Board in this election, then, unless the incumbent director has earlier resigned, his or her term will end on the date that is the earlier of ninety (90) days after the date on which the voting results are determined under California law or the date on which the Board selects a person to fill his or her office.

Change in Fiscal Year.Year In December 2005,. On February 1, 2008, the Company changed its fiscal year end from DecemberMarch 31 to the Saturday nearest March 31. As31 of each year. The Company will now follow a result, certain informationfiscal calendar consisting of four quarters with 91 days, each ending on the Saturday closest to the calendar quarter-end and a 52-week fiscal year with 364 days, with a 53-week year every five to six years. The Company’s 2008 fiscal year began on April 1, 2007 and ended March 29, 2008. Information in this proxy statement isProxy Statement presented for both the Company’sour fiscal year ended March 31, 2006 (also29, 2008 is referred to herein as “fiscal 2006”)2008”.

Internet Availability of Proxy Statement and its transition period2008 Annual Report. The accompanying Notice of January 1, 2005 through2008 Annual Meeting of Shareholders, this Proxy Statement, the Annual Report on Form 10-K for the fiscal year ended March 31, 2005.29, 2008 and a sample proxy card may be viewed, printed or downloaded from www.99only.com/investors/annualreport.htm.

ITEM 1: | ELECTION OF DIRECTORS |

Item 1 is the election of nine members of the Board of Directors. In accordance with the Company’sour bylaws, 99¢ Only Stores’our directors are elected at each annual meeting and hold office until the next annual meeting and until their successors are elected and qualified. The Company’sOur bylaws provide that the Board of Directors shall consist of no less than seven and no more than eleven directors as determined from time to time by the boardBoard of directors.Directors. The Board of Directors currently consists of ten directors, but the size will be reduced to nine members as of the date of the annual meeting.directors.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. If any nominee is unable or unwilling to serve as a director at the time of the annual meeting or any adjournmentsadjournment thereof, the proxies will be voted for such other nominee(s) as shall be designated by the current Board of Directors to fill any vacancy. We have no reason to believe that any nominees will be unable or unwilling to serve if elected as a director.

The Board of Directors proposes the election of the following nominees as directors:

| Jennifer Holden Dunbar | Jeff Gold |

| Eric Flamholtz | Marvin Holen |

| Lawrence Glascott | Eric Schiffer |

| Peter Woo | |

If elected, each of the nominees is expected to serve until the 20072009 annual meeting of shareholders and thereafter until his or her successor is duly elected and qualified.

| ITEM 2: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee has appointed BDO Seidman, LLP as our independent registered public accounting firm to audit our consolidated financial statements for our fiscal year ending March 28, 2009. During fiscal 2008, BDO Seidman, LLP served as our independent registered public accounting firm and also provided certain other audit-related services. See “Independent Auditor Fees and Services” below. Representatives of BDO Seidman, LLP are expected to attend the annual meeting, be available to respond to appropriate questions and, if they desire, make a statement.

.

Although not required by our Articles of Incorporation or Bylaws, we are seeking shareholder ratification of BDO Seidman, LLP as our independent registered public accounting firm. We are doing so because we believe it is a matter of good corporate governance. If BDO Seidman, LLP’s appointment is not ratified, the Audit Committee will reconsider whether to retain BDO Seidman, LLP, but still may retain them. Even if the appointment is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in our and our shareholders’ best interests.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE ABOVE PROPOSAL

ITEM | 3: SHAREHOLDER PROPOSAL TO A SHAREHOLDER VOTE |

John Chevedden has notified us that he intends to present a proposal at the annual meeting. The proposal is set forth below, along with a recommendation of the Board that you vote AGAINST the proposal. We accept no responsibility for the accuracy of the proposal or the proponent’s supporting statement. Mr. Chevedden’s address and share ownership will be provided to shareholders promptly upon a written request to the Corporate Secretary at the Company’s address included in this Proxy Statement, or by calling the Corporate Secretary at (323) 980-8145.

Stockholder Proposal

RESOLVED, Shareholders request that our Board redeemadopt a bylaw or charter amendment that any future or current poison pill unless such poison pill isbe subject to a shareholder vote as a separate ballot item, to be held as soon as maypossible. A poison pill is such a drastic step that a required shareholder vote on a poison pill is important enough to be practicable. Chartera permanent part of our bylaws or bylaw inclusion if practicable.charter - rather than a fleeting short-lived policy.

The Corporate Library, http://www.thecorporatelibrary.com/, an independent investment research firm said: We support the adoption of policies requiring shareholder approval of poison pills, either before adoption or within a new poison pill. To give ourshort time thereafter - six months is sufficient time, we think, for a board valuable insight on our viewsto explore alternatives in the event of their poison pill, a vote would occur even if our board had promptly terminated a new poison pill because our board could turnaround and readopt their poison pill.hostile bid, but not so long that shareholders are completely disempowered.

John Chevedden, Redondo Beach, Calif., who sponsored a number of proposals on this topic, won an impressive 58% average yes-vote in 2005 through late-September. The Council of Institutional Investors www.cii.org formally recommends adoption ofsaid the advantage for adopting this proposal topic.

| · | The Corporate Library rated our company: |

“D” in Overall Board Effectiveness.High Concern” regarding our accounting.

| · | At our May 2007 annual meeting our CEO said he talked to 10 director candidates. Thus it appears that our CEO had the greatest influence in selecting directors. |

| · | Three directors were age 72-76 - Retirement concern. |

| · | Three directors had 17-years tenure plus one director had 43-years tenure - Independence concern. |

| · | SOX 404 violation: Due to material weaknesses, our management concluded that our Company’s internal control over financial reporting was not effective. |

| · | We did not have an Independent Chairman or even a Lead Director. |

| · | Three of our 9 directors were insiders or insider-related. |

| · | Outside directors should own stock and two of our outside directors owned zero stock. |

| · | Howard Gold received 10-times as many withhold votes as some of our other directors. |

.

| · | No Cumulative voting right. |

| · | No shareholder right to act by written consent. |

| · | We have not yet graduated to a majority-vote election standard. |

Yes on 2

3

3

The Company does not have a shareholder rights plan, or “poison pill,” in place and therefore has no poison pill to redeem or submit to a shareholder vote.

We are committed to acting in the best interests of the Company and its shareholders in all matters of corporate governance, including any decision to adopt and maintain a shareholder rights plan. In response to statements included in the above proposal, shareholders should also recognize that a majority of the Company’s directors are independent in accordance with the standards of the New York Stock Exchange, that all of our directors own stock in the Company, and that as described elsewherethe Company’s bylaws provide for majority voting for directors in this Proxy Statement, the Company has adopted corporate governance guidelines to promote the effective governance of the Company.uncontested elections, consistent with state law.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE AGAINST THE ADOPTION OF THIS PROPOSAL. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED AGAINST THIS PROPOSAL UNLESS OTHERWISE SPECIFIED BY THE SHAREHOLDER IN THE PROXY.

INFORMATION WITH RESPECT TO NOMINEES AND EXECUTIVE OFFICERS

The following table sets forth information with respect to the Company’sour directors and executive officers as of February 28, 2007 and information with respect to Peter Woo, Jennifer Holden Dunbar and Howard Gold who became directors on April 3, 2007:June 30, 2008:

Directors:

Name: | Age at June 30, 2008 | Year First Elected or Appointed Director | Principal Occupation | |||

| David Gold | 76 | 1965 | David Gold has been Chairman of the Board since the founding of the Company in 1965. Mr. Gold has over 50 years of retail experience. | |||

| Jeff Gold | 40 | 1991 | Jeff Gold joined the Company in 1984 and has served in various managerial capacities. From 1991 to 2004 he served as Senior Vice President of Real Estate and Information Systems. In January 2005, he was promoted to President and Chief Operating Officer. | |||

| Eric Schiffer | 47 | 1991 | Eric Schiffer joined the Company in 1991 and has served in various managerial capacities. In March 2000, he was promoted to President and in January 2005 to Chief Executive Officer. From 1987 to 1991, he was employed by Oxford Partners, a venture capital firm. Mr. Schiffer is a graduate of the Harvard Business School. | |||

| Lawrence Glascott | 74 | 1996 | Lawrence Glascott serves on the Company’s Audit, Compensation and Nominating and Corporate Governance Committees. Mr. Glascott has also served as Chairman of the Board of Directors of General Finance Corporation since November 2005. Before Mr. Glascott retired in 1996, he had been Vice President – Finance of Waste Management International, an environmental services company, since 1991. Prior thereto, Mr. Glascott was a partner at Arthur Andersen LLP and was the Arthur Andersen LLP partner in charge of the 99¢ Only Stores account for six years. Additionally, Mr. Glascott was in charge of the Los Angeles based Arthur Andersen LLP Enterprise Group practice for over 15 years. | |||

| Marvin Holen | 78 | 1991 | Marvin Holen serves on the Company’s Audit, Compensation and Nominating and Corporate Governance Committees. He is an attorney and in 1960 founded the law firm of Van Petten & Holen. He served on the Board of the Southern California Rapid Transit District from 1976 to 1993 (six of those years as the Board’s President). He served on the Board of Trustees of California Blue Shield from 1972 to 1978, on the Board of United California Savings Bank from 1992 to 1994 and has served on several other corporate, financial institution and philanthropic boards of directors. He currently serves on the Board of United Pacific Bank. | |||

| Eric G. Flamholtz | 65 | 2004 | Eric G. Flamholtz, Ph.D., serves on the Company’s Compensation and Nominating and Corporate Governance Committees. He has been a professor of management at the Anderson Graduate School of Management, University of California at Los Angeles since 1973 and in 2006 became Professor Emeritus. He is President of Management Systems Consulting Corporation, which he founded in 1978. He is the author of several books, including Growing Pains: Transitioning from an Entrepreneurship to a Professionally Managed Firm. As a consultant he has extensive experience with firms ranging from entrepreneurships to Fortune 500 companies, including Starbucks, Navistar, Inc., Baskin Robbins, Jamba Juice and Grocery Outlets. | |||

| Jennifer Holden Dunbar | 45 | 2007 | Jennifer Holden Dunbar serves on the Company’s Audit, Compensation and Nominating and Corporate Governance Committees. She has served as a director of Big 5 Sporting Goods Corp. since February 2004, as well as from 1992 to 1997. Ms. Dunbar has served as Principal and Managing Director of Dunbar Partners, LLC, an investment/advisory firm since 2005. From 1994 to 1998, she was a partner of Leonard Green & Partners, L.P., a private equity firm, which she joined in 1989. During the 1990s, she served as a director of several public and private companies including Thrifty Payless, Inc., Kash N’ Karry Food Stores, Inc. and Gart Sports Company. Ms. Dunbar received her MBA from the Stanford Graduate School of Business in 1989. | |||

| Peter Woo | 59 | 2007 | Peter Woo serves on the Company’s Compensation and Nominating and Corporate Governance Committees. He is a founder, co-owner and President of Megatoys, Inc., a toy and general merchandise manufacturer and import/export company headquartered in Los Angeles that he founded in 1989. Megatoys operates buying, logistics and export facilities in Hong Kong and mainland China, as well as warehouse and distribution facilities in the U.S. Mr. Woo was instrumental in the redevelopment of the downtown Los Angeles area now known as the “toy district”, and has served as an advisor on international trade to the City of Los Angeles. | |||

| Howard Gold | 48 | 1991 | Howard Gold joined the Company in 1982 and has served in various managerial capacities. In 1991 Mr. Gold was named Senior Vice President of Distribution, and in January 2005 he was named Executive Vice President of Special Projects. He has been an executive with the Company for over 20 years. He served as a director of the Company from 1991 until March 2005, and re-joined the Board of Directors in April 2007. | |||

| Other Executive Officers: | ||||||

| Robert Kautz | 50 | Robert Kautz joined the Company in November 2005 as Executive Vice President and Chief Financial Officer. He was the CEO/CFO of Taste Good LLC, a private start-up in food production and distribution, from September 2004 until he joined the Company. He was CFO and subsequently CEO for Wolfgang Puck Casual Dining and Wolfgang Puck Worldwide where he was employed from 1998 until July 2004. Mr. Kautz is a graduate of the Harvard Business School. | ||||

Name: | Age at February 28, 2007 | Year First Elected or Appointed Director | Principal Occupation | |||

| David Gold | 74 | 1965 | David Gold has been Chairman of the Board since the founding of the Company in 1965. Mr. Gold has over 50 years of retail experience. | |||

| Jeff Gold | 39 | 1991 | Jeff Gold joined the Company in 1984 and has served in various managerial capacities. From 1991 to 2004 he served as Senior Vice President of Real Estate and Information Systems. In January 2005, he was promoted to President and Chief Operating Officer. | |||

| Eric Schiffer | 46 | 1991 | Eric Schiffer joined the Company in 1991 and has served in various managerial capacities. In March 2000, he was promoted to President and in January 2005 to Chief Executive Officer. From 1987 to 1991, he was employed by Oxford Partners, a venture capital firm. Mr. Schiffer is a graduate of the Harvard Business School. | |||

| Lawrence Glascott | 72 | 1996 | Lawrence Glascott serves on the Company’s Audit, Compensation and Nominating and Corporate Governance Committees. Mr. Glascott has also served as Chairman of the Board of Directors of General Finance Corporation since November 2005. Before Mr. Glascott retired in 1996, he had been Vice President - Finance of Waste Management International, an environmental services company, since 1991. Prior thereto, Mr. Glascott was a partner at Arthur Andersen LLP and was the Arthur Andersen LLP partner in charge of the 99¢ Only Stores account for six years. Additionally, Mr. Glascott was in charge of the Los Angeles based Arthur Andersen LLP Enterprise Group practice for over 15 years. |

| Marvin Holen | 77 | 1991 | Marvin Holen serves on the Company’s Audit, Compensation and Nominating and Corporate Governance Committees. He is an attorney and in 1960 founded the law firm of Van Petten & Holen. He served on the Board of the Southern California Rapid Transit District from 1976 to 1993 (six of those years as the Board’s President). He served on the Board of Trustees of California Blue Shield from 1972 to 1978, on the Board of United California Savings Bank from 1992 to 1994 and on several other corporate, financial institution and philanthropic boards of directors; he currently serves on the Board of United Pacific Bank. | ||||

| Eric G. Flamholtz | 64 | 2004 | Eric G. Flamholtz, Ph.D., serves on the Company’s Compensation and Nominating and Corporate Governance Committees. He has been a professor of management at the Anderson Graduate School of Management, University of California at Los Angeles since 1973 and in 2006 became Professor Emeritus. He is President of Management Systems Consulting Corporation, which he founded in 1978. He is the author of several books including Growing Pains: Transitioning from an Entrepreneurship to a Professionally Managed Firm. As a consultant he has extensive experience with firms ranging from entrepreneurships to Fortune 500 companies, including Starbucks, Countrywide Financial Corporation, Baskin Robbins, Jamba Juice and Grocery Outlets. | ||||

| Thomas Unterman | 62 | 2004 | Thomas Unterman serves on the Company’s Audit and Nominating and Corporate Governance Committees. Mr. Unterman is the Founder and Managing Partner of Rustic Canyon Partners, a sponsor of venture capital and private equity investment funds. Previously, from 1992 through 1997, he was employed by the Times Mirror Company (since acquired by the Tribune Company) most recently as Executive Vice President and Chief Financial Officer of The Times Mirror Company, a diversified media company. Mr. Unterman also serves on the boards of several privately held companies in which Rustic Canyon has an investment and several charitable organizations. As previously disclosed, Mr. Unterman is not standing for re-election at the Company’s annual meeting. | ||||

| Jennifer Holden Dunbar | 44 | 2007 | Jennifer Holden Dunbar has served as a director of Big 5 Sporting Goods Corp. since February 2004, as well as from 1992 to 1997. Ms. Dunbar has served as Principal and Managing Director of Dunbar Partners, LLC, an investment/advisory firm since 2005. From 1994 to 1998, she was a partner of Leonard Green & Partners, L.P., a private equity firm, which she joined in 1989. During the 1990s, she served as a director of several public and private companies including Thrifty Payless, Inc., Kash N’ Karry Food Stores, Inc. and Gart Sports Company. Ms. Dunbar received her MBA from the Stanford Graduate School of Business in 1989. | ||||

| Peter Woo | 57 | 2007 | Peter Woo is a founder, co-owner and President of Megatoys, Inc., a toy and general merchandise manufacturer and import/export company headquartered in Los Angeles that he founded in 1989. Megatoys operates buying, logistics and export facilities in Hong Kong and mainland China, as well as warehouse and distribution facilities in the U.S. Mr. Woo was instrumental in the redevelopment of the downtown Los Angeles area now known as the “toy district”, and has served as an advisor on international trade to the City of Los Angeles. | ||||

| Howard Gold | 47 | 2007 | Howard Gold joined the Company in 1982 and has served in various managerial capacities. In 1991 Mr. Gold was named Senior Vice President of Distribution, and in January 2005 he was named Executive Vice President of Special Projects. He has been an executive with the Company for over 20 years. He previously served as a director of the Company from 1991 until March 2005. | ||||

Jeff Gold and Howard Gold are the sons of David Gold, and Eric Schiffer is the son-in-law of David Gold.

.

6

| FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS |

Independence

The Board of Directors has concluded that the following directors are independent in accordance with the director independence standards of the New York Stock Exchange, and it has determined that none of them has a material relationship with the Company which would impair his or her independence from management or otherwise compromise his or her ability to act as an independent director: Lawrence Glascott, Marvin Holen, Eric Flamholtz, Tom Unterman, Jennifer Holden Dunbar and Peter Woo. The Board of Directors made this same determination with respect to Tom Unterman, who did not stand for re-election at our annual meeting in May 2007.

Meetings and Committees

The Board of Directors held a total of 1011 meetings during the fiscal year ended March 31, 2006 and two meetings during the transition period of January 1, 2005 through March 31, 2005.2008. The number of Board committee meetings is set forth below. During the fiscal year ended March 31, 2006 and the three month period ended March 31, 2005,2008, each incumbent director attended 75 percent or more of the aggregate of (i) the total number of board meetings (held during the period for which he or she has been a director) and (ii) the total number of meetings held by all committees of the boardBoard of Directors on which he or she served (during the periods that he or she served). Directors are encouraged but not required to attend annual meetings of shareholders. All of the Company’sour directors at the date of the 20052006 annual meeting of shareholders attended that meeting.

The Board of Directors has established an Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. The Audit Committee during the three month transition period ended March 31, 2005 and during fiscal 2006 consistedcurrently consists of Messrs. Glascott (Chairman), Holen and Ms. Dunbar. Tom Unterman eachwas a member of whomthe Audit Committee until April 2007. Each of these directors meets the criteria for independence set forth in the New York Stock Exchange’s rules and in Rule 10A-3 under the Securities Exchange Act. The Board of Directors has determined that Mr. Glascott is an “audit committee financial expert” as that term is used in Item 401(h) of Regulation S-K promulgated under the Securities Exchange Act. The Audit Committee selects the independent registered public accountants to perform the Company’sour audit and periodically meets with the independent registered public accountants and the Company’sour management to review matters relating to the Company’sour financial statements, accounting principles and system of internal accounting controls, and reports its recommendations as to the approval of the Company’sour financial statements to the Board of Directors. The role and responsibilities of the Audit Committee are more fully set forth in a written charter adopted by the Board of Directors, which is available on the Company’sour website at www.99only.com. The Audit Committee held ten12 meetings during the fiscal year ended March 31, 2006. There were two meetings held during the transition period ended March 31, 2005. Following the date of the annual meeting, Jennifer Holden Dunbar will become a member of the Audit Committee.2008.

In addition, the Board of Directors has a Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee during fiscal 2006 consistedcurrently consists of Messrs. Holen (Chairman), Flamholtz, Glascott, Woo and Ms. Dunbar. Mr. Unterman eachwas a member of whomthe Nominating and Corporate Governance Committee during until April 2007. Each of these directors is independent in accordance with New York Stock Exchange rules. The role of the Nominating and Corporate Governance Committee is to assist the Board of Directors by identifying, evaluating and recommending director nominees and recommending and monitoring corporate governance guidelines applicable to the Company. In identifying director nominees, the Nominating and Corporate Governance Committee looks for independent individuals with business and professional experience, relevant industry knowledge or experience, an ability to read and understand financial statements and other relevant qualifications. Each nominee for election as a director is standing for reelection after being elected by the shareholders at the 2004our 2007 annual meeting of shareholders with the exception of Ms. Dunbar and Messrs. Woo and Howard Gold. Ms. Dunbar and Mr. Woo were recommended to the nominating committee by Eric Schiffer. Howard Gold is a former director and executive officer of the Company. There is not a formal policy by which shareholdersshareholders. A shareholder may recommend a director candidates, but the members ofcandidate for the Nominating and Corporate Governance Committee will certainly consider candidates recommendedCommittee’s consideration by shareholders. A shareholder wishing to submit such a recommendation should sendsubmitting a letter to theour Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Director Nominee Recommendation.” The letter must identify the author as a shareholder and provide a brief summary of the candidate’s qualifications, as well as contact information for both the candidate and the shareholder. At a minimum, candidates for election to the Board should meet the independence requirements of the New York Stock Exchange and Rule 10A-3 under the Securities Exchange Act, as well as the criteria identified above. Candidates recommended by shareholders will be evaluated in the same manner as candidates recommended by anyone else. The Nominating and Corporate Governance Committee held threetwo meetings during the fiscal year ended March 31, 2006. There were no meetings during the transition period ended March 31, 2005.2008. A copy of the charter of the Nominating and Corporate Governance Committee is available on the Company’sour website at www.99only.com.

.

7

Pursuant to its charter, the Compensation Committee has the sole authority to retain and terminate any compensation expert to be used to assist in the evaluation of executive compensation. During fiscal 2008, the Compensation Committee retained the services of Watson Wyatt to review our long-term incentive program and to assist the Compensation Committee in developing, together with management, a long-term incentive program to support our strategic priorities. In particular, Watson Wyatt was asked to (i) determine current peer practices and best practices in long-term incentive plan design, (ii) design a long-term incentive program that would cost effectively support the Company’s key objectives and motive key employees to achieve stretch goals, and (iii) document key design features of the agreed upon program. Watson Wyatt has not provided other services to the Company. The long-term incentive program that resulted from this process is described below under “Compensation Discussion and Analysis.”

Executive Sessions

The Board has adopted a procedure for executive sessions of non-management directors whereby a presiding non-management director for each session is determined on a rotating basis, proceeding in alphabetical order. Interested parties with concerns regarding the Company may contact the non-management directors by sending a letter in care of theour Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023; the mailing envelope must contain a clear notation that it is confidential and for the non-management directors.

Compensation of Directors

The following table provides information regarding the compensation earned by or awarded to each of our non-executive directors during fiscal 2008:

| Name | Fees Earned or Paid in Cash ($) | Option Awards ($)(a)(b) | Total ($) | |||||||||

| Eric Flamholtz | 53,264 | 28,811 | 82,075 | |||||||||

| Lawrence Glascott | 64,782 | 28,811 | 93,593 | |||||||||

| Marvin Holen | 61,614 | 28,811 | 90,425 | |||||||||

| Tom Unterman (c) | 7,750 | 1,539 | 9,289 | |||||||||

| Jennifer Holden Dunbar | 66,250 | 22,787 | 89,037 | |||||||||

| Peter Woo | 56,500 | 22,787 | 79,287 | |||||||||

.

8

| (a) | As a result of the delay in our 2006 annual meeting date until May 2007, each of our non-employee directors received his or her annual stock option award of 3,000 options in June 2007 instead of during fiscal 2006. Each of these option awards for Messrs., Flamholtz, Glascott, Holen and Woo and Ms. Dunbar had a grant-date fair value of $42,510 and vests over a three year period. Following our 2007 annual meeting, each of our non-employee directors received his or her annual stock option award (increased to 9,000 options, as described above) in November 2007. Each of these option awards for Messrs., Flamholtz, Glascott, Holen and Woo and Ms. Dunbar had a grant-date fair value of $90,990 and vests over a three year period. The amounts reported under “Option Awards” do not necessarily reflect the dollar amounts of compensation actually realized or that may be realized. In accordance with SEC regulations, these amounts reflect the dollar amounts recognized by us for financial statement reporting purposes for fiscal 2008 in accordance with the provisions of FASB Statement No. 123(R), “Share-Based Payment”. See Note 8 of Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for fiscal 2008 filed with the Securities and Exchange Commission on June 11, 2008. |

| (b) | As of March 31, 2008, each non-executive director held options exercisable for the following number of shares of our common stock: Eric Flamholtz, 18,000; Lawrence Glascott, 52,000; Marvin Holen, 52,000; Jennifer Holden Dunbar, 12,000 and Peter Woo, 12,000. |

| (c) | Mr. Unterman did not stand for re-election at the 2006 annual shareholders meeting held on May 11, 2007. |

Compensation Committee Interlocks and Insider Participation

The Board of Directors has adopted corporate governance guidelines to serve as a flexible framework within which the Board may conduct its business, subject to occasional deviations. A copy of the corporate governance guidelines is available on the Company’sour website at www.99only.com.

Shareholder Communication with the Board of Directors

Shareholders who wish to communicate with the Board of Directors or a particular director may send a letter to the Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” All such letters must identify the author as a shareholder and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Corporate Secretary will make copies of all such letters and circulate them to the appropriate director or directors.

| CODE OF BUSINESS CONDUCT AND ETHICS |

The Board of Directors has adopted a Code of Business Conduct and Ethics applicable to all of our directors, officers and employees of the Company.employees. A copy of the Code of Business Conduct and Ethics is available on the Company’sour website at www.99only.com.

.

Name and Principal Position | Fiscal Year Ended (except 2005, which is a three month fiscal period) (1) | Annual Compensation (except 2005, which is a three month fiscal period) (1) | Other Annual Compensation | Long-Term Compensation (Number of Securities Underlying Options((#) | All Other Compensation ($) | ||||||||||||||

Salary | Bonus | ||||||||||||||||||

| Eric Schiffer (a) | 3/31/2006 | $ | 120,000 | - | - | - | - | ||||||||||||

| Chief Executive | 3/31/2005 | 32,308 | - | - | - | - | |||||||||||||

| Officer | 12/31/2004 | 124,615 | - | - | - | - | |||||||||||||

| 12/31/2003 | 117,692 | - | - | - | - | ||||||||||||||

| Jeff Gold (b) | 3/31/2006 | $ | 122,308 | - | - | - | - | ||||||||||||

| President and Chief | 3/31/2005 | 34,615 | - | - | - | - | |||||||||||||

| Operating Officer | 12/31/2004 | 124,615 | - | - | - | - | |||||||||||||

| 12/31/2003 | 123,231 | - | - | - | - | ||||||||||||||

| Howard Gold (c) | 3/31/2006 | $ | 122,308 | - | - | - | - | ||||||||||||

| Executive Vice | 3/31/2005 | 34,615 | - | - | - | - | |||||||||||||

| President Of | 12/31/2004 | 124,615 | - | - | - | - | |||||||||||||

| Special Projects | 12/31/2003 | 124,615 | - | - | - | - | |||||||||||||

| Michael Zelkind | 3/31/2006 | $ | 240,000 | $ | 26,250 | - | - | - | |||||||||||

| Former Executive | 3/31/2005 | 50,000 | 8,750 | - | - | - | |||||||||||||

| Vice President | 12/31/2004 | 35,000 | 25,000 | - | 40,002 | - | |||||||||||||

| Of Supply Chain and Merchandising | 12/31/2003 | - | - | - | - | - | |||||||||||||

| Robert Kautz | 3/31/2006 | $ | 129,500 | $ | 20,000 | - | 150,000 | - | |||||||||||

| Chief Financial | 3/31/2005 | - | - | - | - | - | |||||||||||||

| Officer | 12/31/2004 | - | - | - | - | - | |||||||||||||

| 12/31/2003 | - | - | - | - | |||||||||||||||

| EXECUTIVE COMPENSATION |

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Objectives

Our compensation program for named executive officers (“executives”) is different than many public company programs. Given the desire of each of Eric Schiffer, our CEO, Jeff Gold, our President and COO, and Howard Gold, our Executive Vice President of Special Projects, to have his compensation unchanged, following the annual review of their compensation by the Compensation Committee, the Compensation Committee did not propose an increase to the compensation of these executives for fiscal 2008 and does not anticipate proposing any material increase in the compensation of these three executives in the foreseeable future. In addition, at the request of each of these executives, the Compensation Committee did not approve any bonuses or equity-based awards for these executives during fiscal 2008. The compensation of each of these executives has been relatively flat for at least the last five years, and no bonuses or equity-based awards have been paid to them since 1997. We believe that the significant Company share ownership of these individuals serves to motivate and retain them and to align their interests with the long term interests of our shareholders better than any compensation program we might otherwise adopt for their benefit. For these three executives, the only material element of their compensation is their base salary.

Our compensation program with respect to our other executives is designed to:

| · | provide competitive compensation |

| Name | Number Of Securities Underlying Option Granted (a) | Percent Of Total Options Granted To Employees in Fiscal Year (b) | Exercise Or Base Price | Expiration Date | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term | ||||||||||||||

| 5% | 10% | ||||||||||||||||||

| Eric Schiffer | - | - | - | - | - | - | |||||||||||||

| Jeff Gold | - | - | - | - | - | - | |||||||||||||

| Howard Gold | - | - | - | - | - | - | |||||||||||||

| Michael Zelkind | - | - | - | - | - | - | |||||||||||||

| Robert Kautz | 150,000 | 85.7 | % | $ | 9.54 | 11/11/2015 | $ | 899,948 | $ | 2,280,645 | |||||||||

Number of Securities Underlying Unexercised Options at March 31, 2006 | Value of Unexercised In-the-Money Options At March 31, 2006(a) | ||||||||||||||||||

Name | Shares Acquired Upon Exercise | Value Realized | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||||

| Eric Schiffer | - | - | 75,006 | - | $ | 720,058 | - | ||||||||||||

| Jeff Gold | - | - | 75,006 | - | $ | 720,058 | - | ||||||||||||

| Howard Gold | - | - | 75,006 | - | $ | 720,058 | - | ||||||||||||

| Michael Zelkind | - | - | 13,334 | 26,666 | $ | 4,467 | $ | 8,934 | |||||||||||

| Robert Kautz | - | - | - | 150,000 | - | $ | 603,000 | ||||||||||||

| · | base salary, |

| · | annual cash bonus, and |

| · | long-term incentives. |

We have chosen these primary elements because each supports achievement of one or more of our compensation objectives, and (iii) long-term incentives. Each element of compensationeach has an integral role in our total compensation program.

Our Compensation Committee reviews the total executive compensation program and specific individual compensation arrangements of executives at least annually. During fiscal 2008, the Compensation Committee retained Watson Wyatt Worldwide as an independent compensation consultant to provide advice and perspective to the Compensation Committee with respect to the Compensation Committee’s review of our long-term compensation program. GivenIn connection with this review, the current share ownershipCompensation Committee considered aggregated survey data compiled by Watson Wyatt Data Services, as described below, in determining the amounts of Howard Gold, Jeff Goldlong-term incentive awards. The Compensation Committee also considered peer data compiled by Watson Wyatt with respect to the long-term incentive practices of a broad set of public company retailers in determining the structure of its long-term incentive program. The Compensation Committee considered this data because it believes we compete against companies both within and Eric Schiffer,outside our own industry to fill many of our top management positions.

Our CEO evaluates each executive and makes recommendations about compensation to the Compensation Committee. The Compensation Committee considers these membersrecommendations but is ultimately responsible, together with the Board, for the approval of management have chosenall executive compensation arrangements. Our CEO is not to receive bonuses or stock option awards.present during the Committee’s deliberations about his own compensation.

.

10

Base Salary. Base salaries are negotiated at the commencement of an executive officer’sexecutive’s employment with us and the Company and are reviewedCompensation Committee reviews them annually. Base salaries are designed to reflect the position, duties and responsibilities of each executive, officer, the cost of living in the area in which the officer is located,Southern California, and the market for base salaries of similarly situated executives at other companies engaged in businesses similar to that of the Company and the Company’s performance against its financial and strategic goals.companies. Base salaries are generally designedintended to be at the mid-range of salaries of comparable companies. Duringother public companies with similar size in terms of number of employees and unit volumes, in similar industries, and with similar growth plans, challenges, and profit potential, all in the judgment of our Board members and human resource professionals based on their substantial accumulated experience and knowledge of these matters. The initial salary of Mr. Kautz in fiscal year ended March 31, 20062007 ($400,000) was based on the competitive market for his position and his compensation at previous employers. Mr. Schiffer also discussed the transition period ended March 31, 2005,total compensation package for Mr. Kautz, and each component thereof, and comparative numbers from other companies, with the national executive search firm the Company had retained to fill his position, although this search firm was not retained by the Company to provide such advice. Mr. Schiffer shared the views of this firm with the Compensation Committee. Based on its annual review, the Compensation Committee determined that the base salary of Mr. Kautz remained appropriate and no increase was made for fiscal 2008. The base salaries of the other executive officers, Messrs. Eric Schiffer, served as the Company’s Chief Executive Officer. Mr. Schiffer’s base annual salary of $120,000 was determinedJeff Gold, and Howard Gold, were originally set based upon his service to the Company, the financial performance of the Company in the fiscal year ended March 31, 2006on their earlier responsibilities and the transition period ended March 31, 2005, histheir stock ownership, position in the Company. See “Executive Compensation -- Summary Compensation Table.”and have remained unchanged at their request at $120,000 per annum (see further discussion above under “Compensation Objectives”).

Annual Cash Bonuses. All executive officersexecutives are eligible to receive annual incentive bonuses in amounts approved at the discretion of the Compensation Committee and the Board of Directors. Executive officer bonuses are calculated based on the Company’s annual performance, individual performance, the executive’s position and his base compensation level.level, the performance of the individual executives in achieving specified individual goals, typically related to the short and long term business and financial performance of our Company, as well as, in the case of Mr. Kautz, the terms of his employment agreement. The terms of Mr. Kautz’s employment agreement provide that he is entitled to an annual bonus of up to 50% of his base salary (or $200,000) based on achievement of goals related to both Company and personal performance. In fiscal 2008, the Compensation Committee approved annual goals for Mr. Kautz specifically related to increased sales, decreased store and distribution/transportation costs, strategic planning, weekly and monthly reporting enhancements, timely SEC filings and the elimination of material weaknesses in our internal control over financial reporting. Mr. Kautz also was assigned monthly goals during the year by the CEO and achieved a majority of both the annual and monthly goals. The Compensation Committee noted that Mr. Kautz has delivered strong performance for the Company throughout his tenure with the Company and received his full bonus in fiscal 2007, but Mr. Kautz mutually agreed with the Company not to receive any cash bonus in fiscal 2008. Messrs. Howard Gold,Eric Schiffer, Jeff Gold and Eric SchifferHoward Gold have also chosen not to receive an annual incentive bonus for fiscal 20062008.

Long-Term Incentives.

Overview. We have historically provided our executives (other than, at their election, Eric Schiffer, Jeff Gold and the transition period ended March 31, 2005.

PSU/Option Grants. The Compensation Committee, with the Securitiesinput from Watson Wyatt and Exchange Commission (“SEC”) during the transition period ended March 31, 2005 and fiscal 2006,management, established long-term incentive award values by management level. In establishing these values, the Compensation Committee did not approve its traditionalconsidered the 2007/2008 Report on Long Term Incentives; Plans, Policies and Practices, prepared by Watson Wyatt Data Services. Based on the assumption that our salary levels were at the market median level reported, Watson Wyatt utilized this report (together with a regression analysis for the size of our Company) to determine target values for an annual grant to employeeslong-term incentive award by salary level. These target values were then multiplied by five, based on the Compensation Committee’s goal of establishing an award that would ordinarily have been madeprovide long-term incentive compensation for recipients over the period from March 30, 2008 through March 31, 2012. The Compensation Committee then allocated PSUs and stock options to each recipient based on the applicable five-year target dollar value. The split between PSUs that vest only based on attaining increasing levels of earnings and options that vest over time was determined to provide a significant incentive to achieve increases in early fiscal 2006 until June 2006. All options granted in June 2006,earnings as well as a significant incentive to increase the small number of option grants made during fiscal 2006, were granted at the fair market value of shares of our common stock.

.

11

The Compensation Committee approved an award of 280,000 PSUs to Mr. Kautz out of a total of 1,598,799 PSUs awarded to officers and other key personnel. The Compensation Committee also approved a grant of 110,678 stock options to Mr. Kautz, with a three year vesting period, out of a total of 614,452 stock options granted to officers and other key personnel. The long term incentive awards are the Company’s Common Stockonly equity awards expected to be awarded to each participant through the end of the performance period, March 31, 2012. The crediting of the PSUs is based on achievement of increases in earnings. At their request, no stock option or PSU awards were made to Eric Schiffer, Jeff Gold or Howard Gold.

PSU Structure. The PSUs are eligible for conversion, on a one-for-one basis, to shares of our common stock based on (1) attainment of one or more of eight specified levels of EBT attainment (as defined below) during the performance period (consisting of fiscal years 2008 through 2012), (2) continuous employment with the Company, and (3) certain vesting requirements. During the period beginning on March 31, 2008 and ending on the date we file our annual financial statements for fiscal year 2012, goal attainment will be measured on each date we file our quarterly and/or annual financial statements with the SEC (each such date, a “measurement date”). To date, no PSUs have been converted to shares.

EBT attainment means the sum of grant.our earnings before taxes for the four most recent fiscal quarters as calculated pursuant to generally accepted accounting principles and reported in our financial statements, as adjusted to exclude: (1) any gains or losses on sales, exchanges or other dispositions of our real estate interests held as of December 31, 2007, and (2) extraordinary items. If we either repurchase shares of our common stock or pay cash dividends to our shareholders during the performance period, the calculation of EBT attainment will also adjust earnings before taxes to include interest income that would have been earned from short term securities in the amount of the cumulative repurchases or dividends during the performance period. The Committee believed that these were appropriate adjustments so that the earnings calculation reflected our ordinary course operations and not extraordinary events, and so that management would not be disincentivized from recommending share repurchases or cash dividends to the Board in light of the negative effect such events would have on our income from investments. The Compensation Committee considersretained the grant of each option subjectively, considering factors suchright to amend the PSU awards, as long as the individualamendments do not (without the recipient’s consent) adversely affect the recipient’s rights. This would allow the Compensation Committee to make adjustments to EBT as may be appropriate to maintain fairness and the desired incentive for executive management to attain long term growth in earnings. PSUs can be credited, in whole, or in part, as follows:

| Performance Level | #1 | #2 | #3 | #4 | #5 | #6 | #7 | #8 | ||||||||||||||||||||||||

| EBT Attainment Required | $ | 18,000,000 | $ | 25,000,000 | $ | 38,000,000 | $ | 50,000,000 | $ | 63,000,000 | $ | 75,000,000 | $ | 87,000,000 | $ | 99,000,000 | ||||||||||||||||

| % of PSUs Credited | 5.0 | % | 10.0 | % | 15.0 | % | 15.0 | % | 15.0 | % | 15.0 | % | 12.5 | % | 12.5 | % |

EBT Attainment will be measured on each measurement date. Each performance level can only be attained once within the performance period; however, more than one performance level can be attained on a given measurement date. Although some of the credited PSUs would continue to be subject to time-based vesting after the end of the performance period, any PSUs that are not credited based on EBT attainment by the end of the performance period will generally be forfeited.

The other compensation plans available to our named executive officers consist of our compensation deferral plan and competitive compensation packages in the industry. Since 1997, Messrs. Howard Gold, Jeff Gold and Eric Schiffer have chosen not to receive bonuses or stock option awards.

Compensation Deferral Plan Plan. Effective January 1, 2000 the Company establishedAs discussed below under Deferred Compensation, we have a voluntary compensation deferral plan for highly compensated employees. Under the compensation deferralthis plan, participantseach executive (and other highly compensated employees) may defer up to 80% of his or her base pay.salary each year.

401(k) Plan. All of our full-time employees are eligible to participate in our 401(k) Plan after one year of service. Prior to fiscal 2007, we could elect to match employee contributions or make discretionary contributions to the 401(k) Plan on behalf of employees, but had elected not to do so. We amended the 401(k) plan in fiscal 2007 to provide for Company matches in cash at a rate of 100% of the first 3% of base compensation that each employee contributes, and 50% of the next 2% of base compensation that an employee contributes, with immediate vesting, as a result of internal surveys and an analysis of various benefits that could be provided in connection with our decision, as discussed in our Form 10-K for fiscal 2007 to discontinue our practice of automatically awarding stock options to most employees throughout the Company. Our executives are also eligible for these Company matches, subject to regulatory limits on contributions to 401(k) plans.

.

12

Omnibus Budget Reconciliation Act Implications for Executive Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), places a limit of $1,000,000 on the amount of compensation that may be deducted by the Company in any year with respect to the Chief Executive Officer and each of the Company’s four most highly paid executive officers other than the Chief Executive Officer and the Chief Financial Officer. Certain “performance-based” compensation that has been approved by the Company’sour shareholders is not subject to the deduction limit. The Company’s 1996 Stock Option Plan isAwards of stock options under our stock option plan are intended to qualify so that awards under the plan constituteas performance-based compensation not subject to Section 162(m) of the Code. The PSU awards do not qualify as performance-based compensation under Section 162(m) because our stock option plan, under which the PSUs were granted, does not include approved performance measures for such equity awards. In addition, the PSU awards were not granted during the first 90 days of the performance period, as required by Section 162(m). This may limit the deductibility of our executive compensation in future periods. All compensation paid to the Company’s employeesour executives in fiscal 20062007 and the transition period ended March 31, 2005 isfiscal 2008 was fully deductible.

Under the terms of each PSU award, including the PSU award granted to Mr. Kautz, if the recipient is terminated for any reason other than death or disability, all PSUs that have not converted to shares shall be forfeited.forfeited and shall lapse for no consideration. Because the PSU awards are intended to cover four years’ worth of long-term incentive compensation, the Compensation Committee decided to provide some acceleration of crediting and vesting of PSUs upon a change of control. The amount of crediting and vesting decreases over the term of the performance period, based on the rationale that the further the Company is into the performance period, the more management will have had the opportunity to achieve the specified earnings goals. A further description of the crediting and vesting of PSUs upon a change of control is set forth below under “Potential Payments Upon Termination or Change of Control.”

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed with management the above Compensation Discussion and Analysis. Based on our review and discussions with management, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

| COMPENSATION COMMITTEE | |

| Jennifer Holden Dunbar (Chairwoman) | |

| Eric G. Flamholtz | |

| Marvin Holen | |

| Lawrence Glascott | |

| Peter Woo | |

13

Summary Compensation Table

The following table sets forth, as to the Chief Executive Officer, Chief Financial Officer and the other two most highly compensated executive officers during fiscal 2008 (the “Named Executive Officers”), information concerning all compensation paid for services to the Company in all capacities during the periods indicated.

| Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($) | Stock Awards ($)(d) | Option Awards ($)(e) | All Other Compensation ($)(f) | Total ($) | |||||||||||||||||||||

| Eric Schiffer | 2008 | 120,000 | (a) | - | - | - | 5,140 | 125,140 | ||||||||||||||||||||

| Chief Executive | 2007 | 117,692 | (a) | - | - | - | 1,540 | 119,232 | ||||||||||||||||||||

| Officer | ||||||||||||||||||||||||||||

| Robert Kautz | 2008 | 400,000 | - | - | 269,508 | 7,297 | 676,805 | |||||||||||||||||||||

| Chief Financial Officer | 2007 | 415,385 | 255,000 | - | 219,500 | 3,995 | 893,880 | |||||||||||||||||||||

| Jeff Gold | 2008 | 120,000 | (b) | - | - | - | 4,996 | 124,996 | ||||||||||||||||||||

| President and | 2007 | 120,000 | (b) | - | - | - | 1,367 | 121,367 | ||||||||||||||||||||

| Chief Operating | ||||||||||||||||||||||||||||

| Officer | ||||||||||||||||||||||||||||

| Howard Gold | 2008 | 120,000 | (c) | - | - | - | 5,140 | 125,140 | ||||||||||||||||||||

| Executive Vice President Of | 2007 | 120,000 | (c) | - | - | - | 1,540 | 121,540 | ||||||||||||||||||||

| Special Projects | ||||||||||||||||||||||||||||

| (a) | Includes $88,269 and $92,769 in discretionary contributions made to a deferred compensation plan for fiscal 2008 and 2007, respectively. |

| (b) | Includes $80,031 and $96,254 in discretionary contributions made to a deferred compensation plan for fiscal 2008 and 2007, respectively. |

| (c) | Includes $80,031 and $96,254 in discretionary contributions made to a deferred compensation plan for fiscal 2008 and 2007, respectively. |

| (d) | Mr. Kautz was granted a PSU award during fiscal 2008, as described above under “Compensation Discussion and Analysis -- Long-Term Incentives.” No expense was recognized in fiscal 2008 related to this grant due to the uncertainty of achieving the performance targets. |

| (e) | The dollar amounts do not necessarily reflect the dollar amounts of compensation actually realized or that may be realized. In accordance with SEC regulations, these amounts reflects the dollar amounts recognized by us for financial statement reporting purposes for fiscal 2008 in accordance with the provisions of FASB Statement No. 123(R), “Share-Based Payment”. See Note 8 of Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for fiscal 2008 filed with the Securities and Exchange Commission on June 11, 2008. |

| (f) | Other compensation for Mr. Schiffer, Jeff Gold, Howard Gold and Robert Kautz includes matching contribution under the 401(k) Plan and life insurance premiums. |

.

14

Deferred Compensation

We have a deferred compensation plan to provide certain key management employees the ability to defer up to 80% of their base compensation and bonuses. The plan is an unfunded nonqualified plan. The deferred amounts and earnings thereon are payable to participants, or designated beneficiaries, at specified future dates, upon retirement or death. We do not make contributions to this plan or guarantee earnings. Funds in the plan are held in a rabbi trust. In accordance with EITF No. 97-14, “Accounting for Deferred Compensation Arrangements Where Amounts Earned are Held in a Rabbi Trust,” the assets and liabilities of a rabbi trust must be accounted for as if they are our assets and liabilities. The assets held in the rabbi trust are not available for general corporate purposes. The rabbi trust is subject to creditor claims in the event of insolvency.

The following table shows the deferred compensation that was deferred by each Named Executive Officer during fiscal 2008:

| Name | Executive Contributions in Last Fiscal Year ($) (a) | Registrant Contributions in Last Fiscal Year ($) | Aggregate Earnings in Last Fiscal Year ($) | Aggregate Withdrawals/Distributions ($) | Aggregate Balance at Last Fiscal Year-End ($) | ||||||||||

| Eric Schiffer | 88,269 | - | (25,008) | - | 946,347 | ||||||||||

| Robert Kautz | - | - | - | - | - | ||||||||||

| Jeff Gold | 80,031 | - | (11,073) | - | 941,438 | ||||||||||

| Howard Gold | 80,031 | - | (11,138) | - | 946,584 |

| Reflects amounts reported as compensation earned by Named Executive Officers in the Summary Compensation Table. |

.

15

Grants of Plan-Based Awards in Fiscal 2008

The following table shows information regarding each grant of a plan-based award made to a Named Executive Officer during fiscal 2008:

| Estimated Future Payouts Under Equity Incentive Plan Awards | |||||||||||||||||||||||||||||||

| Name | Grant Date | Threshold (#) | Target (#) | Maximum (#)(b) | All Other Stock Awards: Number of Shares of Stock or Units (#) | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise Base Price of Options Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($)(c) | |||||||||||||||||||||||

| Eric Schiffer | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Jeff Gold | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Howard Gold | - | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Robert Kautz | 1/11/2008(a) | 110,678 | 6.58 | 728,261 | |||||||||||||||||||||||||||

| 1/11/2008 | - | - | 280,000 | - | - | - | 1,842,400 | ||||||||||||||||||||||||

| (a) |

| (b) |

| (c) | The dollar amounts in this column represent the full grant date fair value of the equity awards granted to Mr. Kautz in fiscal 2008 calculated in accordance with the provisions of FASB Statement No. 123(R), “Share-Based Payment”, except that estimated forfeitures have been disregarded for this purpose. See Note 8 of Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for fiscal 2008 filed with the Securities and Exchange Commission on June 11, 2008. |

.

Outstanding Equity Awards at Fiscal Year End

The following table sets forth, for each of the Named Executive Officers, information on the current holdings of stock options and stock awards held as of March 29, 2008:

| Option Awards | Stock Awards | ||||||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) | Number of Securities Underlying Unexercised Options (#) | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock that have not vested (#) | Market Value of Shares or Unit of Stock that have not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have not vested (#)(a) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other rights that have not vested ($)(b) | ||||||||||||||||||

| Exercisable | Unexercisable | ||||||||||||||||||||||||||

| Eric Schiffer | - | - | - | - | - | ||||||||||||||||||||||

| Jeff Gold | - | - | - | - | - | ||||||||||||||||||||||

| Howard Gold | - | - | - | - | - | ||||||||||||||||||||||

Robert Kautz | 100,000 | 50,000 | 9.54 | 11/11/2015 | |||||||||||||||||||||||

| - | 110,678 | - | 6.58 | 1/11/2018 | 280,000 | 2,746,800 | |||||||||||||||||||||

| (a) | Amounts in this column represent the maximum number of shares that can be obtained upon conversion of the PSU award granted to Mr. Kautz during fiscal 2008. This award is for a multi-year period, as described above under “Compensation Discussion and Analysis -- Long-Term Incentives. We have presented the maximum number of shares that can be obtained over this multi-year period because the PSU awards do not provide for threshold or target performance measures. |

| (b) | The market value of the shares was calculated by multiplying the number of shares by $9.81, the closing price of our common stock on March 28, 2008. |

17

Options Exercises and Stock Vested during Fiscal Year 2008

The following table sets forth, for each of the Named Executive Officers, information regarding options and stock awards, exercised and vested during fiscal 2008:

| Option Awards | Stock Awards | |||||||||||||||

| Number of Shares Acquired on Exercise | Value Realized on Exercise | Number of Shares Acquired on Exercise | Value Realized on Exercise | |||||||||||||

| Name | (#) | ($) | (#) | ($) | ||||||||||||

| Eric Schiffer | - | - | - | - | ||||||||||||

| Jeff Gold | - | - | - | - | ||||||||||||

| Howard Gold | - | - | - | - | ||||||||||||

| Robert Kautz | - | - | - | - | ||||||||||||

Potential Payments Upon Termination or Change of Control

The following section describes the benefits that may become payable to our Named Executive Officers, in connection with certain terminations of their employment with the Company and/or a change in control of the Company.

Pursuant to our employment agreement with Mr. Kautz, upon a termination during the five-year term of the agreement either by us without cause or by Mr. Kautz upon our failing to cure a material breach of the agreement after notice, Mr. Kautz is entitled to a payment equal to 12 months of his salary at the rate in effect on his termination date and the vesting of any unvested options from his initial option grant. Upon a termination during the term of the agreement either by us for cause or by Mr. Kautz for any other reason, Mr. Kautz is not entitled to any termination payment and all of his unvested options shall be forfeited. In addition, the initial options granted to Mr. Kautz under his employment agreement shall become 100% vested on any “Acceleration Date” as defined in his employment agreement, which includes various change of control events. Under this agreement, we have also agreed to enable Mr. Kautz to exercise his options simultaneous with the event causing the Acceleration Date.

During fiscal 2008, Mr. Kautz received an award of PSUs, as discussed above under “Long-Term Incentives” and “Post-Termination Arrangements.” If Mr. Kautz’s employment terminates upon his death, all time-based restrictions on credited PSUs will lapse and the related PSUs will convert to shares. In addition, his estate would receive the benefit of the immediate conversion into shares of a number of PSUs related to the attainment of one additional performance level (or, in the case of a termination when no performance levels have been attained, the attainment of performance level 1). If Mr. Kautz’s employment terminates upon his disability (as defined in the PSU award agreement), all time-based restrictions on credited PSUs will lapse and the related PSUs will convert to shares. In addition, he would receive the benefit of the attainment of any performance level attained on any measurement date(s) during the period of time that is 12 months after the date of disability. If a change of control (as defined in the PSU award agreement) occurs during the performance period or up to two years from the final measurement date (and subject to Mr. Kautz’s continuous employment through such time), any PSUs that have been credited based on EBT attainment but remain subject to vesting will become fully vested and convert to shares on the date of the change of control. In addition, if a change of control occurs during the performance period, the crediting and vesting of PSUs related to one additional performance level for every two quarters that remain in the performance period will also accelerate and the related shares will be paid out. If an odd number of quarters remains within the performance period, vesting for 50% of the PSUs related to the fractional performance level will accelerate.

In addition, upon a termination of employment or change of control, each of Eric Schiffer, Jeff Gold and Howard Gold is entitled to a distribution of all deferred amounts and earnings thereon held on his behalf pursuant to our deferred compensation plan described above under “Deferred Compensation.”

The following table sets forth information on the potential payments to the Named Executive Officers upon termination or change of control, assuming a termination or change of control occurred on March 29, 2008, at which time the closing price of our common stock was $9.81.

.

18

| Name | Cash Payment($) | Acceleration of Vesting of Options ($)(c) | Acceleration of Crediting/Vesting of PSUs ($) | |||||||||

| Eric Schiffer | ||||||||||||

· Termination | 946,347 | (a) | ||||||||||

· Change in Control | 946,347 | (a) | ||||||||||

| Robert Kautz | ||||||||||||

· Termination Without Cause or With Good Reason | 400,000 | (b) | 370,990 | - | ||||||||

· Change in Control | 400,000 | (b) | 370,990 | 2,746,800 | (d) | |||||||

· Death | 137,340 | (e) | ||||||||||

· Total and Permanent Disability | (f) | |||||||||||

| Jeff Gold | ||||||||||||

· Termination | 941,438 | (a) | ||||||||||

· Change in Control | 941,438 | (a) | ||||||||||

| Howard Gold | ||||||||||||

· Termination | 946,584 | (a) | ||||||||||

· Change in Control | 946,584 | (a) | ||||||||||

| (a) | Assumes a termination on March 29, 2008 and payments based on the aggregate balance in the deferred compensation plan as of such date. As discussed above deferred compensation cash payments consists entirely of cash contributed by the named executive officers. |

| (b) | Assumes a termination on March 29, 2008 and payments based on a base salary as of March 29, 2008. |

| (c) | Amounts determined by multiplying the number of options for which vesting is accelerated by our closing stock price on March 28, 2008 ($9.81 per share) and subtracting the exercise price of such option shares. |

| (d) | Amount obtained by multiplying (i) 280,000, which is the number of PSUs that would be converted into shares based on a change of control occurring on March 29, 2008, by (ii) the closing stock price on March 28, 2008 of $9.81 per share. |

| (e) | Amount obtained by multiplying (i) 14,000, or 5% of 280,000, which is the number of PSUs that would be converted into shares based on achieving performance level 1 at March 29, 2008, by (ii) the closing stock price on March 28, 2008 of $9.81 per share. |

| (f) | As described above, the number of PSUs that would convert into shares upon a termination of Mr. Kautz’s employment due to disability is determined based the performance levels, if any, that are attained on any measurement dates during the period of time that is 12 months after the date of disability. Because we do not know which, if any, performance levels will be attained during this period of time, we do not believe it is possible to provide a calculation of the share payment that would be due Mr. Kautz as a result of such a termination of employment. No PSUs were credited to Mr. Kautz as of March 29, 2008, and therefore there would not have been any benefit to Mr. Kautz from the lapsing of time-based restrictions on credited PSUs on this date. |

.

19

| REPORT OF THE AUDIT COMMITTEE |

The Audit Committee of the Board of Directors, which consists entirely of directors who meet the independence requirements of the New York Stock Exchange and Rule 10A-3 under the Securities Exchange Act, has furnished the following report:

The Audit Committee assists the Board in overseeing and monitoring the integrity of the Company’s financial reporting process, its compliance with legal and regulatory requirements and the quality of its internal and external audit processes. The role and responsibilities of the Audit Committee are set forth in a written Charter adopted by the Board. The Audit Committee reviews and reassesses the Charter annually and recommends any changes to the Board for approval.

The Audit Committee is responsible for overseeing the Company’s overall financial reporting process. In fulfilling its responsibilities for the financial statements for fiscal year 2006 and the transition period ended March 31, 2005,2008, the Audit Committee:

| 1. | Reviewed and discussed the audited financial statements for the fiscal year ended March |

| 2. | Discussed with BDO Seidman, LLP the matters required to be discussed by Statement on Auditing Standards No. 61 |

| 3. | Received written disclosures and a letter from BDO Seidman, LLP regarding its independence as required by Independence Standards Board Standard |

The Audit Committee also considered the status of pending litigation, taxation matters and other areas of oversight relating to the financial reporting and audit process that the Audit Committee determined appropriate.

Based on the Audit Committee’sour review of the audited financial statements and discussions with management and BDO Seidman, LLP, the Audit Committeewe recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 200629, 2008 for filing with the Securities and Exchange Commission.

| AUDIT COMMITTEE | |

Lawrence Glascott (Chairman) | |

Marvin Holen | |

.

RELATED PERSON TRANSACTIONS |

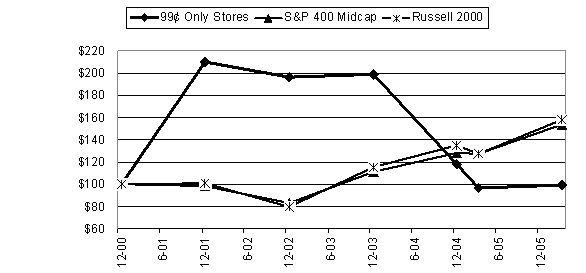

| 12/2000 | 12/2001 | 12/2002 | 12/2003 | 12/2004 | 3/2005 | 3/2006 | ||||||||||||||||

| 99 Cents Only Stores | $ | 100 | $ | 210 | $ | 196 | $ | 199 | $ | 118 | $ | 96 | $ | 99 | ||||||||